Insights

Canadian upstream oil and gas M&A hits Cdn$32.8 billion in March 2017

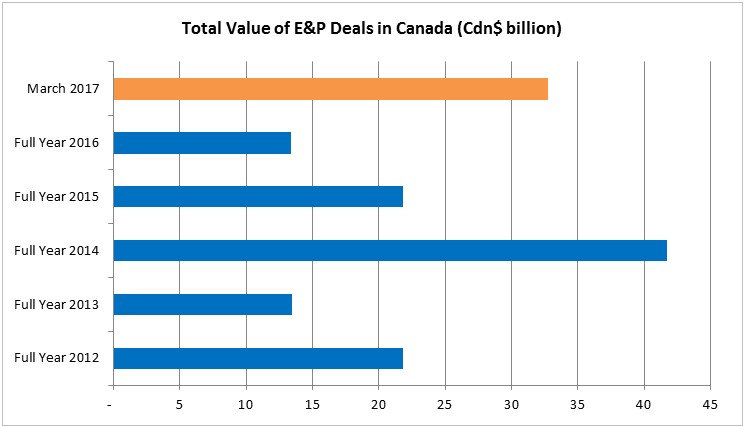

Major deals in the oilsands sector this month meant that the total upstream M&A spend in March 2017 alone eclipsed the annual totals for each of the past five years except for 2014, according to CanOils’ latest monthly M&A review, which can be downloaded here.

Source: CanOils M&A Review, March 2017 (All deals are allocated according to the date of their original announcement)

Cdn$32.1 billion of the total Cdn$32.8 billion spend in March revolved around oilsands assets. Cenovus Energy Inc. (TSX:CVE) bought out its 50% joint venture partner, ConocoPhillips (NYSE:COP) in the FCCL partnership, Canadian Natural Resources Ltd. (CNRL, TSX:CNQ) acquired a 70% interest in the AOSP from Royal Dutch Shell (LSE:RDSA) and Marathon Oil Corp. (NYSE:MRO). Shell itself also acquired a minor stake in AOSP from Marathon to complete the spending.

Away from the oilsands, it was also a relatively busy month considering recent deal trends, with over Cdn$700 million spent on conventional and resource play assets. The largest deal saw Painted Pony Petroleum Ltd. (TSX:PPY) acquire 8,500 boe/d of new Montney production, while Enerplus Corp. (TSX:ERF) and Pengrowth Energy Corp. (TSX:PGF) agreed significant asset sales as well.

March also saw Cenovus place nearly 30,000 boe/d of gas weighted production over 1 million acres up for sale. Birchliff Energy Ltd. (TSX:BIR) and Insignia Energy Ltd. (TSX:ISN) were among the other companies to list assets for sale this month.

For full analysis on all these deals and assets for sale, as well as an outlook for the Canadian oilsands industry, download the CanOils Monthly M&A Review for March 2017 here.