Insights

Dismal Q1 sees global upstream oil and gas deals fetch just $9.8 billion

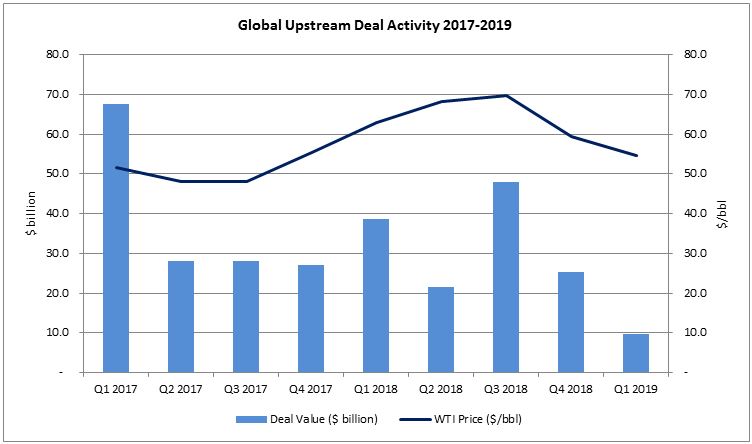

Evaluate Energy’s latest M&A report analyzing global upstream activity shows that just $9.8 billion of new oil and gas M&A deals were agreed during the first quarter of 2019.

This represents a 61% drop on spending in Q4 2018 and a 75% drop compared with Q1 2018.

Low oil prices and changing spending priorities were the two main causes. The full report is available now at this link.

Source: Evaluate Energy Global Upstream M&A Review – Q1 2019

While upstream spending in Canada ground to a halt almost entirely, assets in the United States attracted the bulk of Q1 activity, accounting for 60% – or $5.9 billion – of global upstream spending.

Nonetheless, this was still the lowest spend on U.S. upstream assets since Q1 2015 and a 67% drop from the $17.7 billion recorded in Q4 2018.

Equally, the highest price M&A activity was an offer made by a hedge fund to acquire Permian Basin producer QEP Resources Inc. that is just one option being considered by the target company.

If this deal comes to nothing, Q1 2019 would be the worst individual quarter for U.S. upstream deal-making over the last 10 years.

Evaluate Energy’s M&A review for Q1 2019 is available to download now and includes analysis on the following:

- The changing spending priorities of upstream companies that weakened M&A appetites

- Two years of acquisitions that created a 90,000 boe/d producer in the Appalachian Basin

- Major asset sales around the world by Chevron, Murphy and Marathon Oil