Insights

Nine things we learned from EY’s new production and reserves study

A new EY study based on Evaluate Energy data analyses the data from the 50 largest U.S. oil and gas companies (see notes) between 2013 and 2017. The full EY study can be downloaded here. For a demonstration of Evaluate Energy, where the raw data was extracted from, please contact us.

Here are nine things we learned from the study:

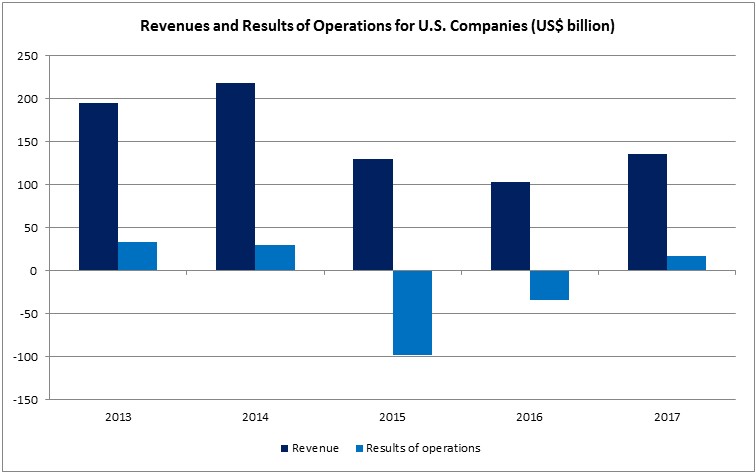

1. The 50 U.S. companies saw revenues and results of operations increase as commodity prices improved during 2017. Revenues in 2017 were US$135.9 billion, up 32% from 2016 and the highest since 2014.

2. The 50 companies continued optimizing their portfolios and cost structures amid the uncertainty surrounding prices throughout the downturn.

Source: Chart created using data published for 50 U.S. oil and gas companies in EY’s US oil and gas reserves and production study for 2018.

3. Capital expenditures totalled US$114.5 billion in 2017, 32% higher than 2016 and 2% lower than 2015. “Growth is observed in all categories of spend. Development and exploration spend increased the most by 49% and 30%, respectively,” the report said.

4. The studied companies drilled 30% and 23% more development and exploration wells, respectively, compared to 2016.

5. Impairments in 2017 were US$10.2 billion, a 47% reduction from 2016 and the lowest since 2013 as the study companies’ outlook of future prices further stabilized.

6. Depreciation, depletion and amortization (DD&A) expenses decreased, mainly due to lower unit-of-production rates, which resulted from reserve revisions and dispositions as well as higher impairments in prior periods.

7. After-tax earnings of US$17.2 billion in 2017 were a substantial improvement from US$33.8 billion in net losses in 2016 and the first combined net income position since 2014.

8. Oil production increased 5% from 2.3 billion bbls in 2016 to 2.4 billion in 2017. The 2017 figure represents a 35% increase from 2013 to 2017. Natural gas production fell in 2017, but this was mainly due to sales of assets to companies outside of the study group.

9. Oil reserves for the study companies increased 21% in 2017 due to significant extensions and discoveries, net upward revisions and purchases partially offset by production and sales. End-of-year gas reserves for the study companies increased 19% in 2017 to 176 tcf, marking the highest level of gas reserves since 2014.

Notes

The 50 companies are the 50 largest in the U.S. based on 2017 end-of-year oil and gas reserve estimates. The study companies cover approximately 44% of the U.S. combined oil and gas production for 2017.